The pay stub can be sent electronically or printed. You can change the colors on the template and you can add your company logo (see step-by-step instructions below).

The paystub template is available as a typeable PDF, MS Word, or Excel document. However, if you want a free pay stub template with a calculator then select the MS Excel version as it will calculate the totals for you.

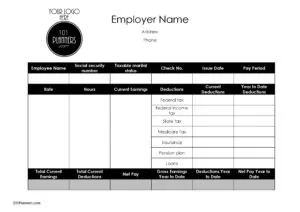

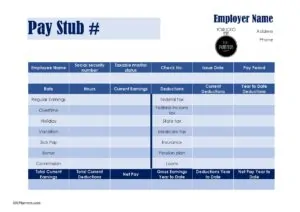

This is a pay stub example with space for deductions, taxes, loans, etc. This version notes the payment method if you pay via different methods. If you have one standard method, you might want to edit this field.

This is a check stub template and it notes the check number assuming the payment was by check. The other fields are similar to the previous template.

check stub template" width="300" height="212" />

check stub template" width="300" height="212" />

This free check stub template is useful when employees receive a check and only work regular hours. There is no section for overtime. There are also no deductions for holidays, vacations, time off, sick leave, personal days, leave of absence, or bonuses. Most of the other templates do have a section for these. You can replace the dummy logo with your company logo.

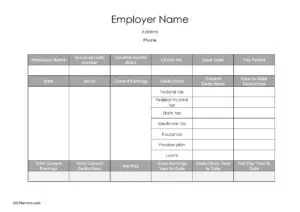

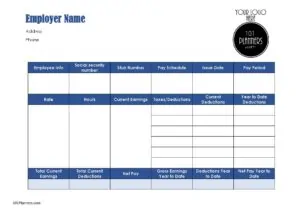

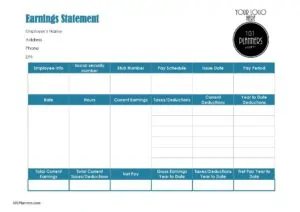

This earnings statement assumes the employee earns wages for regular work hours (i.e. regular earnings). There are no sections for additional income for overtime, bonuses, etc. This sample pay stub also doesn’t have any deductions. It is for employees who are paid for the time they put in where they have no benefits or deductions. There is space to add them if you need to.

This paystub sample has a list of deductions. You can change them if you have different taxes and deductions.

This pay stub form has space for taxes and deductions but none are listed. Type them in the space provided.

check stub template" width="300" height="212" />

check stub template" width="300" height="212" />

This free paycheck stub template has a field for the check number assuming you pay by check. If you don’t, feel free to edit.

A pay stub is a supporting document that accompanies a paycheck or affirms a direct deposit. It is also sometimes referred to as a paycheck stub, payslip, or salary slip. It records gross earnings and deductions (such as taxes, and insurance) and the net amount that the employee actually receives.

Our free pay stub template is a document that makes it easier for you to create a pay stub for your employees. It provides all sections that should be included in a pay stub. All you need to do is customize it to suit your company’s needs and your state’s requirements (certain states have different requirements). You can also add your company’s logo to the template. Once you have customized your template you can use it, again and again, each pay period. Each template is available in 3 different formats (Excel, Word, and a typeable PDF) so be sure to choose a template that best suits your needs. If you want to calculate the number of hours worked or total sums received to date then the Excel format will probably be the best option for you.

Some states require employers to provide pay stubs. However, if you are not required to provide one by law, there are benefits to both employers and employees. Employees can check their wages and deductions to ensure that they are accurate. Employers can use them to ensure that no future claims are made by employees that their wages were incorrectly calculated. It also prevents repeated questions by employees asking how their net wages were calculated. Some people will need to provide their payslips to prove their creditworthiness. This might be required if they need to take a loan, buy a car or home, etc.

The information that should be included generally differs from state to state. However, these sections are usually included:

Gross wages

The gross wages for hourly workers is their hourly rate multiplied by the number of hours they worked. Be sure to include both the hourly rate and the number of hours worked. If the worker receives overtime or a different hourly rate for certain times or days (such as overtime) then separate each hourly rate with the number of hours worked for that rate. It is important that it is very clear how you calculated the gross wages.

The gross wages for a salaried worker is their annual salary divided by 12.

A pay stub usually shows the current gross pay for the current pay period and the total gross wages for that year. Each one is listed in a separate section.

If there are different forms of income such as a bonus then list each form separately for both the current period and the year to date.

Deductions (taxes, insurance costs, retirement plans, contributions, etc)

List all deductions so that the employee can understand what was deducted and why. The deductions are divided into two sections: the current deductions and the year-to-date deductions.

Net pay (wages minus deductions)

This is the amount that is actually given to the employee after subtracting the deductions from the gross pay. Record both the current net pay and the year-to-date net pay.

Employer’s Information such as the company name, address, contact details, etc. Employer Identification Number (EIN) is sometimes also included. It is also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number. It is a unique 9-digit number assigned by the IRS to businesses operating in the US. Other countries have similar identification numbers. Some of the templates have a section for your company’s EIN. If it doesn’t have one and you want to include one then simply add it.

Employee’s Information such as the employer’s name, social security number, job title, etc.

The blank pay stub is available in three different versions, and each one has pros and cons.

This Excel version is closer to a free pay stub generator or a free pay stub template with a calculator. It has built-in formulas that calculate whatever can be calculated. All you need to do is enter the number of hours, rate per hour, and other information. If you save each template under a new name, then most of the information will not need to be repeated each period. With Excel, you can edit practically everything on the form.

This pay stub creator will make the pay stub for you if you type the details but you will need to calculate the totals. On the other hand, with a pay stub template in Word format, you can edit the template, remove lines or columns and add information. Many people are more comfortable using Word than Excel.

This is a fillable pay stub free PDF format. It is typeable but not editable. You can fill in the details but you cannot change the format and you will need to calculate the totals yourself.

If you choose a template that does not have a sample logo then go to insert -> pictures -> this device. Select your logo and drag it to the desired location. If it doesn’t move, then right-click on the logo and go to wrap text -> in front of the text. You can then drag your logo to any position.

If the template has a sample logo, then double click on it and select change picture. If you don’t see it then click on the format tab.

Please note that these are not fake pay stub template printables and they were created for a real business to use for its employees. Fake pay stubs could get you into trouble depending on what you need them for.